A Republican Tax Proposal Could Harm American Businesses

April 6, 2025

Publication: Wall Street Journal

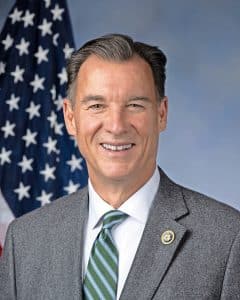

By: Tom Suozzi

Lawmakers are considering limiting the corporate state and local tax deduction, or C-SALT.

Republicans in Congress are drafting a tax bill that raises the state and local tax deduction cap for individuals from $10,000 to $25,000. It’s a good start, but not good enough. The bill would extend most other parts of the 2017 Tax Cuts and Jobs Act—at a cost of more than $4.5 trillion. To offset the deduction cap increase, some lawmakers are considering a dangerous idea: limiting the corporate, and other business, state and local tax deduction, or C-SALT.

As one of the few members of Congress trained as a certified public accountant, I’ve spent my career focused on balancing budgets and fostering economic growth. Eliminating the C-SALT deduction would be a devastating, ill-advised move that would thrust American businesses into turmoil. Even conservative-leaning groups, including the Tax Foundation and Americans for Tax Reform, agree that limits on C-SALT would shrink economic output, reduce jobs and burden businesses nationwide.

State and local taxes aren’t optional. They’re a business cost, just like payroll, rent or electricity. If businesses can no longer deduct state and local taxes from their federal returns, it means they’re taxed on income they never actually made. That’s not only unfair—it’s economic malpractice.

A manufacturer or restaurant could have a tough year, post no profits and then be asked to pay federal taxes on money it already handed over to state and local governments. Eliminating C-SALT might make that business appear profitable, because it wasn’t allowed to deduct its property or sales taxes on its federal return. It would then be liable to pay additional taxes to the federal government out of funds it doesn’t have. That’s unsustainable—and it certainly doesn’t encourage hiring, investment or expansion.

For small businesses operating on tight margins, this change could mean the difference between keeping the lights on or shutting their doors for good. If businesses close, it would mean lost jobs and declining tax revenues for communities to fund such essential services as police, fire departments and public schools.

Some may try to cast this as a problem only in “high tax” states. They’re wrong. This isn’t a blue state versus red state issue. C-SALT deductions matter everywhere: In Texas—a state often touted as “low tax”—62% of all state tax revenue comes from businesses. In Florida, 50% comes from businesses. Limiting C-SALT punishes the businesses that provide essential support for state and local governments.

Further, businesses bear nearly three-quarters of state and local taxes in rural states such as Wyoming and North Dakota—much higher than the nationwide average of businesses bearing about half the tax load. Many red states—including Tennessee and Alabama—have higher-than-average corporate income tax burdens. Eliminating C-SALT would hit businesses in these states particularly hard.

Shockingly, eliminating C-SALT would treat taxes paid in foreign countries more favorably than those paid to U.S. states. American corporations operating abroad use the foreign tax credit to deduct taxes paid to foreign governments. Our tax code is also structured to tax profits earned by U.S. businesses overseas at a lower rate than profits earned domestically.

Why would we encourage American businesses to move abroad? If we punish companies for investing in American communities while rewarding them for moving overseas, we’re simply exporting jobs, innovation and growth.

It’s easy to imagine a large corporation relocating to a tax haven. But for brick-and-mortar businesses such as hotels, restaurants and shopping centers, moving isn’t an option. Landlords, developers and retirees invested in real-estate investment trusts will get hammered. Communities count on these institutions. If Congress strips them of C-SALT deductions, they’ll go under.

In 2023 alone, U.S. businesses paid some $1.1 trillion in state and local taxes. Eliminating the C-SALT deduction could translate to a stealth federal tax increase of between about $430 billion and $800 billion over a 10-year period. That’s not tax reform—that’s a job-killing, growth-slowing economic land mine.

C-SALT deductions aren’t a loophole. They’re a longstanding, bedrock principle of the tax code. They protect against double taxation, support local economies and ensure that businesses aren’t penalized for operating in America. Eliminating these deductions is misguided and reckless. To protect American jobs, strengthen small businesses and keep the economy on solid ground, lawmakers must preserve the C-SALT deduction.

Mr. Suozzi, a Democrat, represents New York’s Third Congressional District.

Recent Articles

Redefine the Democratic Party, return to our roots

There’s Another Way to Fix Immigration

Reopen the government, stop massive health insurance hikes